Introduction

In the job economic situation, freelancing has ended up being an increasingly preferred profession choice for lots of. Whether you're a visuals designer, author, or software application programmer, the attraction of flexible hours and the possibility to deal with varied tasks is hard to withstand. Nonetheless, with excellent flexibility comes terrific obligation. Among one of the most essential elements of running a freelance organization-- typically neglected-- is accounting. Why Every Freelancer Requirements a Solid Accounting Strategy is not just a statement; it's a crucial reality that can make or break your success.

Bookkeeping may not look like the most tempting part of freelancing, but it is vital for several factors. Not just does it assist you track your income and expenditures, however it likewise assists in tax obligation prep work, monetary preparation, and overall business monitoring. So how can freelancers develop a strong bookkeeping strategy? Let's explore this subject in depth.

Understanding Bookkeeping

What is Bookkeeping?

Bookkeeping involves recording everyday monetary transactions and maintaining precise financial records. It's greater than simply crunching numbers; it includes all facets of managing funds for your freelance venture.

Key Components of Bookkeeping

- Income Monitoring: Maintaining tabs on all incoming payments. Expense Administration: Documenting every expenditure incurred. Financial Reporting: Generating reports to assess your monetary health. Tax Preparation: Preparing files required for tax obligation returns.

Why is Accounting Important for Freelancers?

Freelancers often handle several customers and jobs. Without efficient bookkeeping techniques, tracking who owes you money or what costs you have actually incurred can end up being chaotic.

Benefits of Proper Bookkeeping

Financial Clearness: Recognizing your cash flow assists you make educated decisions. Tax Preparedness: Organized documents streamline tax obligation time. Professionalism: Demonstrating great bookkeeping methods improves your reliability with clients.Common Challenges Freelancers Face in Bookkeeping

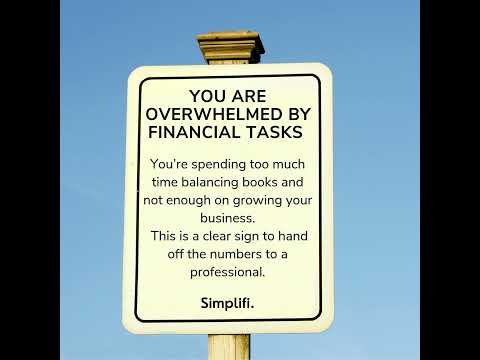

Lack of Time

Freelancers typically locate themselves bewildered with customer job and might disregard their economic documentation.

Complex Financial Situations

Multiple revenue streams can make complex accounting efforts. Handling numerous payment approaches adds to this complexity.

Fear of Numbers

Many individuals avoid bookkeeping due to an uncertainty in their mathematical skills.

Establishing a Solid Accounting Strategy

Choose the Right Tools and Software

Choosing appropriate devices can streamline your bookkeeping process substantially. There are countless software program choices offered ranging from standard spreadsheets to extensive accounting software.

Top Bookkeeping Devices for Freelancers

|Device Call|Functions|Price Variety|| ---------------|--------------------------------------------|---------------|| QuickBooks|Invoicing, cost tracking|$25 - $70/month|| FreshBooks|Time tracking, task administration|$15 - $50/month|| Wave|Free invoicing and accountancy|Free|| Xero|Inventory management|$11 - $62/month|

Set Up a Dedicated Company Account

Having different accounts ensures that personal costs do not join company ones, helping with much easier tracking.

Create a Billing Template

An invoice theme makes payment clients simpler and guarantees you catch all needed information upfront.

Schedule Regular Check-ins

Routine check-ins permit you to remain on top of your funds and change as needed throughout the year.

Developing Good Habits in Bookkeeping

Consistency is Key

Regularly updating your publications leads to much less stress and anxiety come tax obligation season and supplies recurring understanding right into your monetary standings.

Organize Bills Promptly

Storing receipts digitally or physically can conserve time later on when putting together expenses during tax obligation season or audits.

Review Financial News Monthly

Conduct month-to-month evaluations to recognize patterns in earnings and investing which can direct future decisions.

Tax Factors to consider for Freelancers

Understanding Tax Obligations

Freelancers must pay self-employment tax obligations in addition to income taxes on their profits.

FAQs About Taxes

Do freelancers pay tax obligations quarterly?

Yes, consultants generally pay estimated tax obligations quarterly based upon their expected yearly income.

What deductions can consultants claim?

Usual reductions include home office costs, web expenses, and expert development courses.

How do I report freelance income?

Freelance revenue ought to be reported on time C (Form 1040) when submitting taxes.

What happens if I don't file my freelance taxes?

Falling short to submit can lead to fines, passion fees, and even lawsuit from the IRS.

Do I require an accounting professional as a freelancer?

While not necessary, working with an accounting professional can conserve time and make certain compliance with tax laws.

Can I subtract my workspace at home?

Yes, if you use part of your home specifically for business objectives, you might qualify for home office deductions.

Tracking Income Effectively

Multiple Earnings Streams Management

Freelancers typically service different systems (like Upwork or Fiverr). Having a system in place aids keep track of each source effectively without misplacing payments gotten from each platform.

Tips for Tracking Multiple Earnings Streams

Categorize revenue sources. Use bookkeeping software that incorporates with different platforms. Maintain clear records per project/client basis for clarity during tax season.Handling Expenses Like a Pro

Categorizing Your Expenses

Proper categorization permits better evaluation when evaluating financial resources over time-- aiding determine locations where spending could be decreased without giving up quality or solution delivery.

Common Cost Categories

- Office Supplies Marketing Costs Travel Expenses Software Subscriptions

Automating Cost Tracking

Automation reduces some problems by reducing hand-operated access needs while guaranteeing precision gradually; utilizing applications like Expensify can streamline this process.

Creating Financial Reports

Importance of Financial Reports

Regularly created records give insights right into earnings margins which educate critical decision-making relocating forward.

Types of Financial Reports

Profit & & Loss Statement Balance Sheet Cash Flow StatementPlanning Ahead: Budgeting Approaches for Freelancers

Setting Practical Budgets

Creating budget Go to the website plans based on historical bookkeeping service data helps set attainable goals while providing framework around investing patterns.

Steps to Produce Your Budget

Analyze past earnings/expenses Set reasonable targets based upon patterns observed 3. Include pillow funds where necessaryPreparing for Audits: What Freelancers Should Know

Audits might feel daunting; nevertheless preparing effectively streamlines this procedure considerably!

Key Tips:

- Keep organized records in all times! Understand what sets off audits (high reductions etc) Consult with professionals when needed.

Conclusion

In final thought, one can not take too lightly the value of establishing efficient bookkeeping practices as a consultant! As discussed under numerous headings over ( Why Every Freelancer Requirements a Strong Bookkeeping Strategy) encapsulates how vital proper financial monitoring comes to be towards achieving long-lasting success within one's independent career trajectory! Welcome these techniques today-- your future self will certainly say thanks to you!

This short article has actually been developed maintaining SEO criteria in mind while resolving essential pain factors encountered by consultants regarding bookkeeping approaches they need to implement effectively! If you have actually obtained any inquiries concerning just how ideal to manage your financial resources as an independent employee-- don't hesitate!