Introduction to Bookkeeping and Accounting

When it relates to handling financial resources, the phrases "bookkeeper" and "bookkeeper" are actually often made use of reciprocally. However, they embody specific line of work along with special parts, responsibilities, as well as capability. Understanding these differences is essential for businessmen, freelancers, and anyone that wishes to keep a healthy monetary status.

In this article, our experts'll explore the complexities of bookkeeping and accountancy. Our experts'll discover their functionalities, credentials needed for every task, the tools of the business, and eventually assist you calculate which service may be absolute best suited for your needs.

Bookkeepers vs. Bookkeepers: Knowing the Differences

What is Bookkeeping?

Bookkeeping includes the organized recording of economic transactions. This fundamental component of finance acts as the very first step in knowing a company's financial health.

Roles and also Tasks of a Bookkeeper

A bookkeeper typically deals with:

- Recording Transactions: Recording purchases, purchases, slips, as well as payments. Maintaining Financial Records: Making sure that all transactions are actually precisely become part of ledgers or accounting software. Reconciling Accounts: Routinely inspecting financial institution claims against recorded purchases to record discrepancies. Managing Payroll: Processing staff member salaries as well as ensuring tax compliance.

These duties might vary depending upon the size of an organization or organization.

Skills Needed for Prosperous Bookkeeping

To excel in bookkeeping, one requirements:

- Attention to detail Strong company skills Proficiency in audit software Basic understanding of tax regulations

What is Accounting?

Accounting surpasses mere record-keeping; it includes translating economic records to give knowledge in bookkeeping service to an association's performance.

Roles and also Accountabilities of an Accountant

Accountants are charged along with:

- Preparing Financial Statements: Preparing balance sheets, profit statements, as well as capital statements. Conducting Audits: Examining financial reports for reliability and compliance along with regulations. Tax Planning & Compliance: Urging customers on tax tactics while making certain fidelity to laws. Financial Analysis: Offering insights based upon monetary data that can easily lead organization decisions.

Skills Demanded for Productive Accounting

Accountants have to have:

- Analytical skills Strategic thinking Advanced skills in audit principles In-depth know-how of tax obligation laws

Key Differences Between Accountants and also Accountants

1. Attributes of Work

While bookkeepers concentrate on videotaping transactions properly, financial advisors examine those files to give calculated insights.

2. Level of Expertise

Typically, accounting professionals call for additional professional education and learning including a level in accounting or finance matched up to bookkeepers that may just need to have license or even appropriate experience.

3. Qualified Designations

Accountants may accomplish innovative qualifications like certified public accountant (Chartered Accountant), while bookkeepers can earn accreditations like Cost per actions (Accredited Expert Bookkeepers).

4. Complexity of Tasks

Accounting tasks have a tendency to become much more sophisticated including interpretations as well as examinations reviewed to bookkeeping duties which are even more transactional.

Educational Needs for Bookkeepers vs. Accountants

Education Process for Bookkeepers

Bookkeeping typically calls for less formal education and learning than bookkeeping:

|Educational Need|Explanation|| ------------------------|-------------|| Senior High School Diploma|Fundamental demand in many cases|| Qualification Plans|Numerous possibilities available with community colleges or on-line systems|

Education Pathways for Accountants

In Discover more here contrast, accounting professionals typically go after college:

|Educational Demand|Explanation|| ------------------------|-------------|| Bachelor's Level|Usually needed; appropriate fields include Bookkeeping or even Money|| Professional's Degree|Some positions may call for postgraduate degrees|

Tools Made use of through Bookkeepers vs. Accountants

Common Devices for Bookkeeping

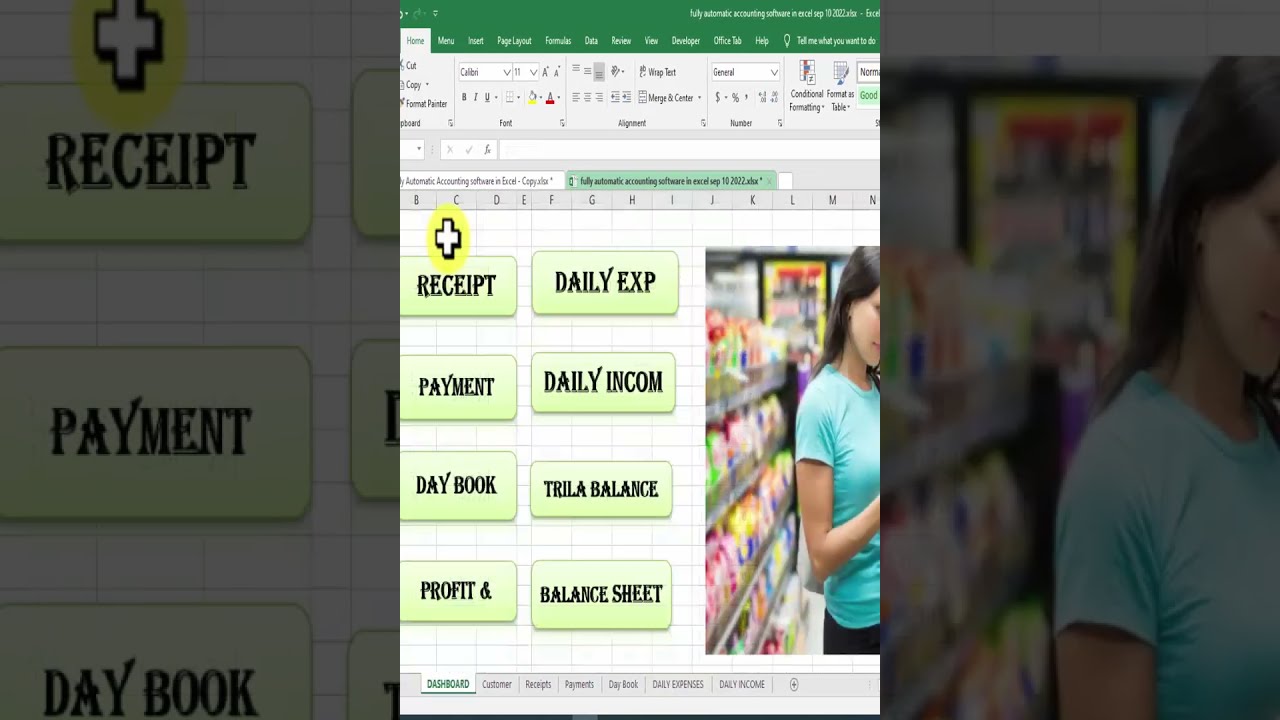

QuickBooks FreshBooks XeroThese tools aid enhance everyday operations like invoicing and expenditure tracking.

Common Tools for Accounting

Microsoft Excel Sage Intacct SAP ERPAccountants usually make use of these resources for additional comprehensive evaluation and disclosing purposes.

The Value of Accurate Financial Reporting

Accurate monetary reporting is essential in both bookkeeping and bookkeeping as it has an effect on decision-making methods within organizations.

Why Accurate Coverage Matters?

Whether it is actually safeguarding finances or attracting clients-- accurate documents develop count on amongst stakeholders by showing a crystal clear image of financial health.

Cost Factors to consider: Employing a Bookkeeper vs. an Accountant

When weighing expenses in between tapping the services of a bookkeeper versus a bookkeeper:

|Solution Kind|Ordinary Price per Hour|| -------------------|----------------------|| Bookkeeper|$twenty - $fifty|| Accounting professional|$fifty - $150|

While employing a financial advisor might seem expensive ahead of time, their expertise can spare you funds by means of helpful tax obligation planning.

Can Someone Perform Both Roles?

It's achievable-- specifically in small businesses where sources are limited-- for one person to handle both bookkeeping and also accountancy duties competently.

However, it's vital that they have the demanded skill-sets from both industries to ensure accuracy throughout all financial activities.

When Should You Choose a Bookkeeper?

If your business is swiftly extending or even if you're bewildered along with day-to-day transaction monitoring-- tapping the services of a specialist bookkeeper can eliminate tension significantly!

When Needs to You Choose an Accountant?

For organizations requiring important advise regarding tax obligations or intricate financial coverage needs-- an accountant would certainly be actually indispensable!

FAQ Section

1. What carries out a bookkeeper do?

A bookkeeper manages day-to-day monetary purchases including videotaping sales/purchases and also fixing up accounts.

2. What carries out an accounting professional do?

An accountant interprets economic records with evaluation while prepping main records like balance sheets.

3. May I be both a bookkeeper as well as an accountant?

Yes! Lots of people carry out both jobs successfully, specifically in much smaller organizations where staffing may be limited.

4. The amount of perform I need to have to pay for bookkeeping services?

The normal by the hour price variations from $twenty-$50 relying on location and skills level.

5. How much do I require to purchase bookkeeping services?

Expect to pay for between $50-$150 every hour depending on complication involved in activities being executed due to the accountant.

6. Which career requires more professional education?

Typically audit calls for a lot more formal education and learning than bookkeeping due its own intricacy involving state-of-the-art logical skills!

Conclusion: Making Educated Options Between Bookkeepers As Well As Accountants

Understanding "Bookkeepers vs. Accountants: Recognizing the Distinctions" helps you make notified selections adapted especially to your requirements!

Both duties participate in important payments in the direction of keeping healthy finances yet vary considerably in relations to obligations needed experience levels-- and expenses related to choosing them!

Ultimately evaluating your very own demands will certainly lead you towards picking either possibility-- or even potentially also tapping the services of each relying on scenarios! Constantly keep in mind that putting in intelligently currently can easily generate higher gains down line as precise report keeping paves means in the direction of success!

By realizing these distinctions accurately-- you'll not simply boost efficiency within procedures but likewise ensure compliance while building rapport along with stakeholders by means of transparent coverage practices!